1 The Company

Wesdome Gold Mines (WDOFF) exlores for, mines, and develops mineral resource properties, primarily gold in Canada.

| Number of shares (May 1, 2014) | 111,107,591 |

| Number of options (May 1, 2014) | 3,328,116 |

| Convertible debentures (May 1, 2014) | 2,808,400 |

| Fully diluted number of shares (May 1, 2014) | 117,244,107 |

| Share price | $0.84 |

| Market cap | $93.3 million |

| Ticker | TSX:WDO,WDOFF |

1.1 History

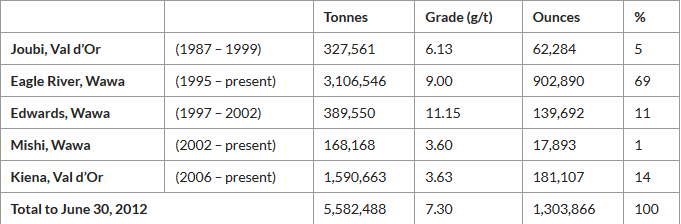

Wesdome Gold Mines was founded in 1976 and became a publicly listed company in 1999. Wesdome merged with River Gold Mines in February 2006 and again with Western Quebec Mines in July 2007. The company has produced over 1.3 million ounces of gold over the last 25 years.

(Source: Wesdome)

1.2 Business Model

Wesdome is 100% unhedged to gold price and has never hedged. The company's strengths are quality gold deposits and an experienced, efficient operating team. Wesdome is a low-overhead, no-nonsense, owner-operated company working for its shareholders.

1.3 Mines

Wesdome has two producing mines located in Canada.

(Source: Investor presentation)

Eagle River Mine

The Eagle River mine is located 50 kilometers due west of Wawa, Ontario, and 60 kilometers southeast of Hemlo. The Eagle River property was purchased in 1994 and the first gold bar was poured in October 1995. The Eagle River mine has produced more than 950,000 ounces since 1995 at an average grade of 9.1 g/tonne. In 2013, Eagle River produced 42,850 gold ounces. The production has grown 52% since 2011.

| Year | 2011 | 2012 | 2013 |

| Production (ounces) | 28,200 | 32,200 | 42,850 |

The 2014 production forecast is 44,000 gold ounces.

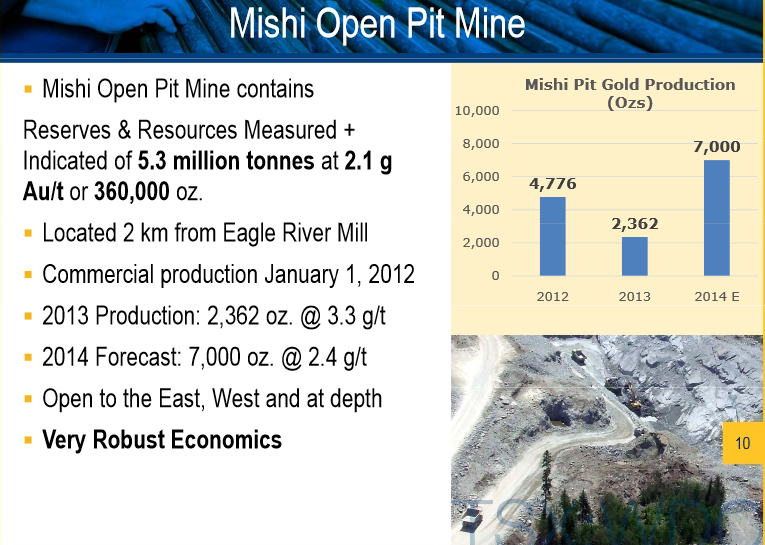

Mishi Mine

The Mishi mine is situated 15 kilometers north of the Eagle River mine and 2 kilometers from the Eagle River mill. Commercial production at Mishi mine started in January 2012. The production is expected to reach 7,000 ounces this year.

(Source: Investor presentation)

Gold reserves at the Eagle River complex have grown 285% since 2008.

(Source: Investor presentation)

2 Management

Rowland Uloth has been the CEO since August 2013. Collectively, Wesdome's executive team has over 70 years of industry experience.

(Source: Investor presentation)

2.1 Insider Ownership

Wesdome's directors and executive officers own 2% of the company.

Here is a table of Wesdome's insider activity by calendar month.

| | Insider buying / shares | Insider selling / shares |

| July 2014 | 0 | 0 |

| June 2014 | 0 | 0 |

| May 2014 | 0 | 0 |

| April 2014 | 5,194 | 0 |

| March 2014 | 24,500 | 0 |

| February 2014 | 10,000 | 0 |

| January 2014 | 0 | 0 |

| December 2013 | 50,000 | 0 |

| November 2013 | 50,000 | 0 |

| October 2013 | 50,000 | 0 |

| September 2013 | 100,000 | 0 |

| August 2013 | 42,800 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 30,000 | 0 |

| May 2013 | 0 | 0 |

| April 2013 | 27,000 | 0 |

| March 2013 | 5,000 | 0 |

| February 2013 | 0 | 0 |

| January 2013 | 150,000 | 0 |

(Note: The table does not include shares purchased by Wesdome. Wesdome has purchased 135,700 shares during April 2013 to July 2014 time period.)

There have been 544,494 shares purchased and there have been zero shares sold by insiders since January 2013.

2.2 Compensation

Here is a table of Wesdome's executive compensation.

(Source: Annual shareholders meeting)

None of the executive officers were paid base salaries more than $200,000 in 2013.

3 Operating Summary

Here is a table of Wesdome's annual gold production since 2008.

| Year | Annual production (ounces) |

| 2008 | 90,004 |

| 2009 | 96,152 |

| 2010 | 68,874 |

| 2011 | 47,747 |

| 2012 | 55,813 |

| 2013 | 52,980 |

The gold production peaked in 2009.

4 Financial Summary

4.1 Current Situation

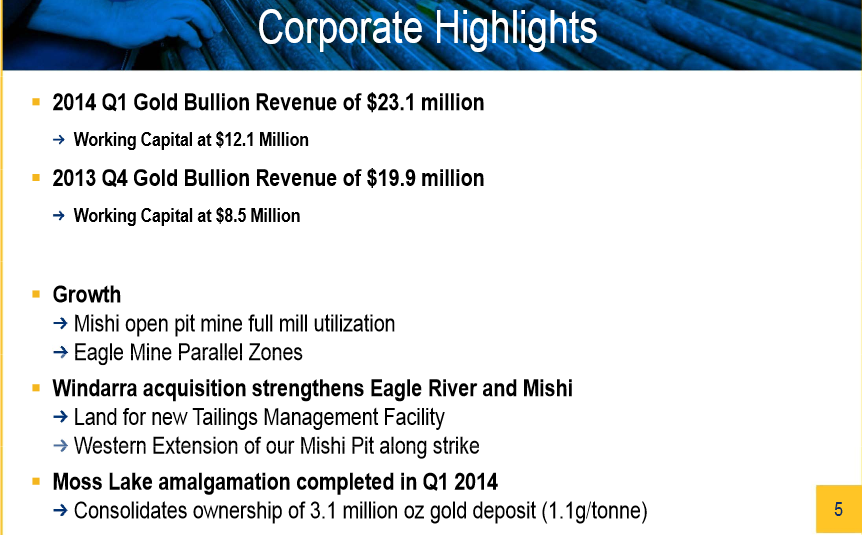

Wesdome reported the first-quarter financial results on May 1 with the following highlights:

| Revenue | C$23.1 million |

| Net income | C$4.2 million |

| Cash | C$7.9 million |

| Debt | C$7.7 million |

| Gold production | 13,730 ounces |

| Production cost | C$977 per ounce |

(Source: Investor presentation)

4.2 Historical Developments

Here is a table of Wesdome's revenue and earnings since 2008.

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| Revenue (C$ millions) | 80.3 | 103.5 | 89.4 | 79.6 | 92.3 | 79.7 |

| Net income/loss (C$ millions) | 9.4 | 32.2 | 5.3 | 0.2 | -45.3 | -3.9 |

| EPS | 0.09 | 0.32 | 0.05 | 0.00 | -0.44 | -0.04 |

Wesdome's revenue and earnings peaked in 2009.

5 Shares

Here is a table of Wesdome's number of shares since 2008.

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| Number of shares (millions) | 99.8 | 100.1 | 100.8 | 101.7 | 101.9 | 102.9 |

Wesdome's number of shares have grown only 3.1% since 2008.

6 Outlook

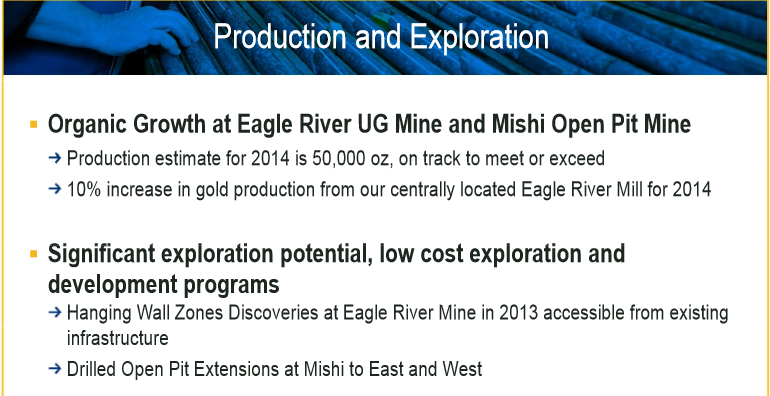

Wesdome's 2014 production guidance is 50,000 gold ounces.

(Source: Investor presentation)

Wesdome's global gold resources are 5.1 million ounces.

(Source: Investor presentation)

7 Risks

I believe the two main risks are the gold price and relatively low gold reserves. Wesdome's production costs were C$977 per ounce in the first quarter. The company's current gold reserves in the Eagle River complex are 281,000 ounces, which will last for about five years. Wesdome is also a penny stock.

8 Conclusion

Wesdome's Eagle River mine has produced more than 950,000 ounces since 1995 at a very high grade of 9.1 g/tonne. The company's production costs were below $1,000 per ounce in the most recent quarter. Wesdome's gold resources are currently 5.1 million ounces, which gives the company ample room to grow. The insiders have been buying the stock since 2013. I believe Wesdome could be a good pick below $1 based on the insider buying.

(Source: Investor presentation)

Disclosure: The author is long TSX:WDO

About the author:maarnioI have 15 years of investing experience. I have traded stocks, commodities and Forex markets.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

TSX:WDO STOCK PRICE CHART

0.88 (1y: +144%) $(function(){var seriesOptions=[],yAxisOptions=[],name='TSX:WDO',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1374469200000,0.36],[1374555600000,0.365],[1374642000000,0.38],[1374728400000,0.41],[1374814800000,0.385],[1375074000000,0.4],[1375160400000,0.42],[1375246800000,0.395],[1375333200000,0.408],[1375765200000,0.395],[1375851600000,0.398],[1375938000000,0.4],[1376024400000,0.405],[1376283600000,0.38],[1376370000000,0.41],[1376456400000,0.38],[1376542800000,0.4],[1376629200000,0.395],[1376888400000,0.4],[1376974800000,0.485],[1377061200000,0.55],[1377147600000,0.65],[1377234000000,0.69],[1377493200000,0.7],[1377579600000,0.73],[1377666000000,0.67],[1377752400000,0.65],[1377838800000,0.64],[1378184400000,0.7],[1378270800000,0.68],[1378357200000,0.66],[1378443600000,0.69],[1378702800000,0.7],[1378789200000,0.67],[1378875600000,0.64],[1378962000000,0.64],[1379048400000,0.64],[1379307600000,0.63],[1379394000000,0.55],[1379480400000,0.73],[1379566800000,0.7],[1379653200000,0.66],[1379912400000,0.62],[1379998800000,0.65],[1380085200000,0.67],[1380171600000,0.69],[1380258000000,0.69],[1380517200000,0.7],[1380603600000,0.64],[1380690000000,0.61],[1380776400000,0.61],[1380862800000,0.56],[1381122000000,0.59],[1381208400000,0.66],[1381294800000,0.61],[1381381200000,0.6],[1381467600000,0.58],[1381813200000,0.56],[1381899600000,0.57],[1381986000000,0.56],[1382072400000,0.56],[1382331600000,0.59],[1382418000000,0.65],[1382504400000,0.62],[1382590800000,0.63],[1382677200000,0.66],[1382936400000,0.68],[1383022800000,0.71],[1383109200000,0.7],[1383195600000,0.66],[1383282000000,0.66],[1383544800000,0.66],[1383631200000,0.64],[1383717600000,0.68],[1383804000000,0.64],[1383890400000,0.66],[1384149600000,0.6],[1384236000000,0.57],[1384322400000,0.52],[1384408800000,0.56],[1384495200000,0.55],[1384754400000,0.51],[1384840800000,0.58],[1384927200000,0.55],[1385013600000,0.57],[1385100000000,0.55],[1385359200000,0.59],[1385445600000,0.57],[1385532000000,0.58],[1385618400000,0.62],[1385964000000,0.56],[! 1386050400000,0.58],[1386136800000,0.61],[1386223200000,0.58],[1386309600000,0.58],[1386568800000,0.58],[1386655200000,0.6],[1386741600000,0.57],[1386828000000,0.6],[1386914400000,0.58],[1387173600000,0.65],[1387260000000,0.63],[1387346400000,0.63],[1387432800000,0.62],[1387519200000,0.58],[1387778400000,0.56],[1387864800000,0.57],[1388124000000,0.63],[1388383200000,0.6],[1388469600000,0.58],[1388642400000,0.63],[1388728800000,0.63],[1388988000000,0.61],[1389074400000,0.64],[1389160800000,0.59],[1389247200000,0.61],[1389333600000,0.62],[1389592800000,0.63],[1389679200000,0.63],[1389765600000,0.65],[1389852000000,0.66],[1389938400000,0.68],[1390197600000,0.68],[1390284000000,0.73],[1390370400000,0.75],[1390456800000,0.74],[1390543200000,0.75],[1390802400000,0.68],[1390888800000,0.68],[1390975200000,0.7],[1391061600000,0.72],[1391148000000,0.67],[1391407200000,0.69],[1391493600000,0.69],[1391580000000,0.68],[1391666400000,0.68],[1391752800000,0.7],[1392012000000,0.72],[1392098400000,0.78],[1392184800000,0.74],[1392271200000,0.77],[1392357600000,0.8],[1392703200000,0.83],[1392789600000,0.8],[1392876000000,0.82],[1392962400000,0.83],[1393221600000,0.79],[1393308000000,0.76],[1393394400000,0.8],[1393480800000,0.84],[1393567200000,0.79],[1393826400000,0.95],[1393912800000,0.9],[1393999200000,0.91],[1394085600000,0.93],[1394172000000,0.91],[1394427600000,0.92],[1394514000000,0.92],[1394600400000,0.94],[1394686800000,0.94],[1394773200000,0.95],[1395032400000,0.94],[1395118800000,0.9],[1395205200000,0.8],[1395291600000,0.85],[1395378000000,0.82],[1395637200000,0.8],[1395723600000,0.74],[1395810000000,0.75],[1395896400000,0.74],[1395982800000,0.78],[1396242000000,0.73],[1396328400000,0.72],[1396414800000,0.77],[1396501200000,0.77],[1396587600000,0.8],[1396846800000,0.79],[1396933200000,0.82],[1397019600000,0.79],[1397106000000,0.78],[1397192400000,0.79],[1397451600000,0.8],[1397538000000,0.76],[1397624400000,0.76],[1397710800000,0.76],[1398056400000,0.76],[1398142800000,0.77],[1398229200000,0.77],[1398